The house Charlotte program try a down payment advice program you to provides financial help so you’re able to certified first-time home buyers who are in need of to invest in a home inside Charlotte limits or perhaps in a great appointed Neighborhood Profile Components (NPAs). Paid and you may given of the Charlotte-Mecklenburg Property Commitment while the City of Charlotte, this method is designed to render home ownership possibilities to anyone and you may parents and increase the production away from reasonable casing during the Charlotte. This method can be used with an effective FHA, Virtual assistant otherwise 30-season fixed rates conventional loan. FHA 203K fund are not allowed.

The cash provided by our house Charlotte system are used to purchase the fresh new initial expenses associated with the purchase out of a good home the deposit and you will/otherwise settlement costs. The amount of money can also be used to possess attention get-down.

By way of example, for people who funds the purchase out-of a house with a great FHA financing, the financial institution will require on the best way to pay a beneficial step three.5% down payment (step 3.5% of your own cost) from the finance. The majority of mortgage loans wanted an advance payment about borrowers except an USDA financing and therefore requires no deposit. With an excellent FHA financing, you’ll be able to help you borrow doing 96.5% of price regarding property. The amount of money for the down-payment having fun with an excellent FHA loan can come from your money, current money from your friends and relatives, otherwise a down payment direction system like the House Charlotte program.

Any kind of version of financing you decide to receive, when buying a property, there will be some closing costs. Closure usually extra up to in the 3.5% to 5% of your own price. When you was indeed browsing pick property getting $130,000, the cash you would need to possess is up to $9,000. For many homebuyers, really it is tough to save yourself this much money, and that the reason behind deposit recommendations programs for instance the Family Charlotte system.

So you can be eligible for our home Charlotte system, numerous affairs was considered as well as family money, credit history, transformation speed and you may location. Homebuyers who would like to be considered for funds from the brand new Family Charlotte program dont keeps a blended home earnings in excess from 110% of median money on the Charlotte city. In general:

- Anyone / family with shared house money away from 80% of your own City Median Income (AMI) or lower than because of their domestic proportions you can expect to qualify for doing $8,500 when you look at the recommendations when they buy a property inside the Charlotte urban area restrictions.

- Some body / families with combined home money from 80% of the AMI because of their family size and you will work as an effective Public service Staff you may qualify for as much as $10,000 inside guidance. Being qualified companies were: the latest C ity from Charlotte, Charlotte-Mecklenburg Schools, Mecklenburg State Sheriff Service, Mecklenburg County Medical and Kitties (Charlotte Transportation Program).

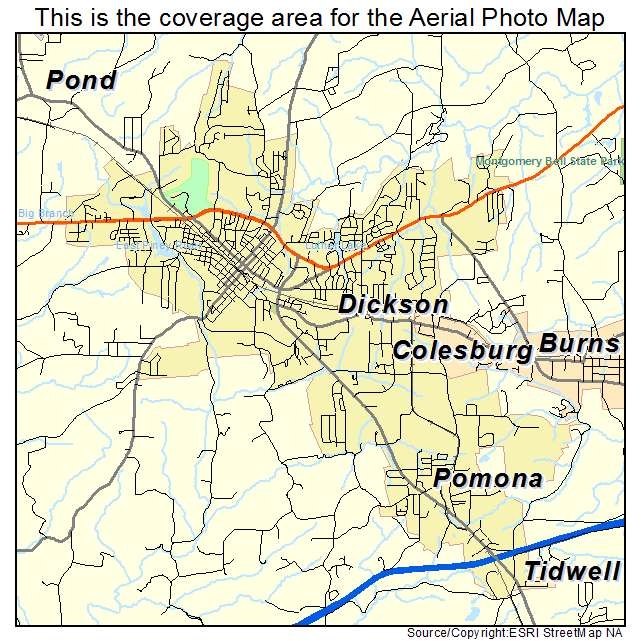

- Individuals / group having joint household income ranging from 80% and you can 110% of your AMI for their home size you may be eligible for $5,000 when you look at the assistance when selecting a home into the a specified Areas Profile Portion (NPAs).

For additional facts about the funds standards recommendations to help you be eligible for our home Charlotte program, visit the house Charlotte money guideline.

The help is available in the type of 5, ten or fifteen-season deferred forgivable financing. To have applicants in the or less than 80% AMI, the assistance could be forgiven immediately following 10 years and specialist-ranked from the 20% a-year carrying out during the season 5. Getting people from the or below 80% AMI and you can behave as a public-service worker, the help might be fully forgiven once five years and pro-rated of the 33% a-year carrying out at the year 3. Last but not least, to own applicants anywhere between 80% so you’re able to 110% AMI, the support will be completely forgiven shortly after 1o many years and you will pro-rated by the 20% undertaking from the seasons 5.

Just how to meet the requirements

The first step should be to call us. We’re going to set you touching an approved Family Charlotte financial. The financial institution have a tendency to apply for the application form for you. The house Charlotte system means homebuyers choosing the advance payment recommendations, for taking 8 circumstances out of domestic client education kinds. Some of those kinds are going to be removed on the internet.

We provide professional training and you will pointers to homebuyers who need when planning on taking advantage of our home Charlotte down payment direction program. Whenever you are looking being qualified because of it program, call us now within (704) 837-4672.

Of good https://paydayloancolorado.net/air-force-academy/ use website links concerning Domestic Charlotte program

Home Charlotte system Apply for our house Charlotte system House Charlotte system neighborhoods Home Charlotte program entertaining society map Home Charlotte system eligible society statistical areas Home Charlotte program income tip Family Charlotte program standards so you can prequalify Home Charlotte program frequently asked questions